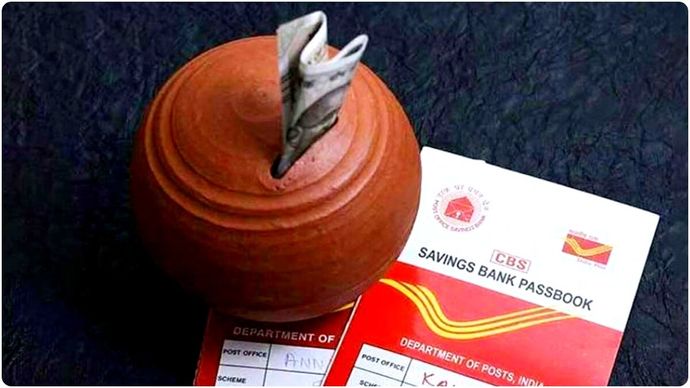

Post Office PPF Scheme

The central government operates several savings schemes, designed to meet the needs of the country’s citizens and provide them with financial security. The Public Provident Fund (PPF) scheme is one such savings plan. PPF is a long-standing and popular savings scheme run by the central government. The PPF scheme currently offers an annual interest rate of 7.1 percent. If you are investing in the PPF scheme, you need to deposit money at least once a year.

Additionally, for your convenience, you can deposit a lump sum into your PPF account annually or continue investing in a maximum of 12 installments. Under the PPF scheme, a minimum of Rs. 500 and a maximum of Rs. 1.50 lakh can be deposited annually. A PPF account matures in 15 years.

A PPF account can be opened at any bank in addition to the post office. If you deposit Rs. 7,000 every month into your PPF account, your annual investment will be Rs. 84,000. If you invest Rs. 84,000 annually in the PPF scheme, after 15 years, at maturity, you will receive a total of Rs. 22,78,197, which includes your investment of Rs. 12,60,000 and interest of Rs. 10,18,197.